Introduction

Cashflow analysis is the lifeblood of effective financial management in accounting. . It represents the movement of cash into and out of a business or personal finances during a specific period. As businesses navigate the complex landscape of revenue and expenses, mastering this crucial aspect becomes paramount.

Components of CashFlow Analysis

- Operating CashFlow (OCF)

Inflows: Cash generated from the core operational activities of the business. This includes revenue from sales, fees, or services provided.

Outflows: Cash payments for operating expenses, raw materials, labor, and other day-to-day operational costs.

- Investing CashFlow (ICF)

Inflows: Cash received from the sale of assets, investments, or any other returns on investments.

Outflows: Cash used for the purchase of assets such as property, equipment, securities, or other investments.

- Financing CashFlow (FCF)

Inflows: Cash received from borrowing, issuing stocks, or any other sources of capital.

Outflows: Cash used to repay debts, buy back stocks, pay dividends, or any other financing-related activities.

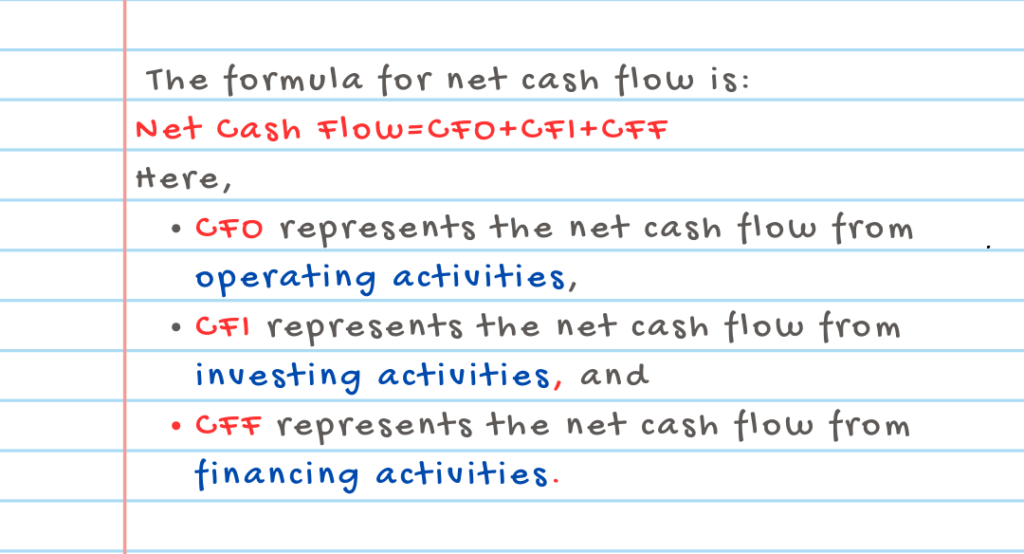

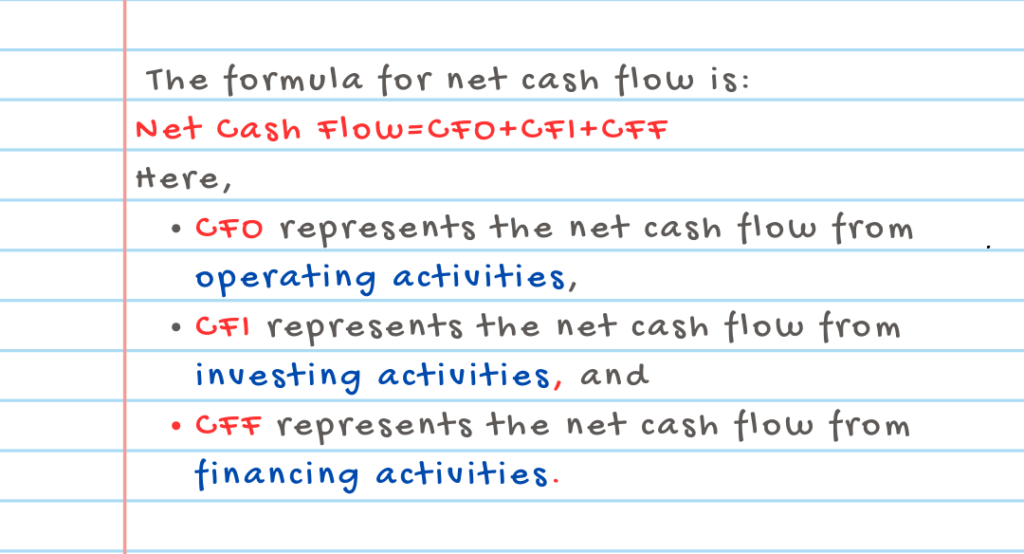

The net cashflow is calculated by summing up the cash flows from these three components. The formula for net cashflow is:

A positive net cashflow indicates that more cash is coming into the business than going out, which is generally considered healthy. On the other hand, a negative net cashflow may indicate that more cash is going out than coming in, which could raise concerns about the financial health of the business.

Monitoring and managing these components of cash flow are essential for making informed financial decisions and ensuring the sustainability of a business or personal financial situation.

Methods of Cash Flow Analysis

The direct and indirect methods are two approaches used to prepare the operating activities section of the cash flow statement, which provides insights into how a company generates and uses cash from its core business operations. Both methods aim to reconcile net income with the actual cash generated or used by the business.

Direct Method:

1. Cash Collections:

– Identify and list all cash collections from customers during the period. This includes cash sales and collections from accounts receivable.

2. Cash Payments:

– List all cash payments made during the period, such as payments to suppliers, employees, and other operating expenses.

3. Operating Cash Flow:

– Calculate the net cash flow from operating activities by subtracting cash payments from cash collections.

4. Advantages:

– Provides a clear and detailed view of actual cash transactions.

– Offers transparency into specific cash inflows and outflows related to operating activities.

5. Disadvantages:

– Can be time-consuming and costly to implement as it requires detailed transaction information.

– Companies may prefer the indirect method due to its simplicity.

Indirect Method:

1. Start with Net Income:

– Begin with the net income from the income statement.

2. Adjust for Non-Cash Items:

– Add back non-cash expenses like depreciation and amortization to net income.

– Subtract non-cash revenues, such as gains on the sale of assets.

3. Adjust for Changes in Working Capital:

– Adjust for changes in working capital by accounting for changes in current assets (like accounts receivable and inventory) and current liabilities (like accounts payable).

4. Operating Cash Flow:

– Calculate the net cash flow from operating activities by adjusting net income for the non-cash items and changes in working capital.

5. Advantages:

– Simpler and less time-consuming compared to the direct method.

– Relies on readily available information from the income statement and balance sheet.

6. Disadvantages

– May lack the granularity of the direct method, making it harder to identify specific cash inflows and outflows.

Comparison

Similarities:

– Both methods aim to reconcile net income with cashflow from operating activities.

– Both methods provide insight into a company’s ability to generate cash from its core operations.

Differences:

– The direct method directly lists cash transactions, while the indirect method starts with net income and adjusts

for non-cash items and changes in working capital.

– The direct method is more detailed but less commonly used due to its complexity.

– The indirect method is more widely adopted as it is simpler and requires less detailed information.

In practice, many companies prefer the indirect method because it is less resource-intensive, but both methods are acceptable for preparing the operating activities section of the cash flow statement. The choice often depends on reporting requirements and the level of detail desired by stakeholders.

Significance in Financial Decision-Making

Cashflow analysis serves as a compass for financial decisions:

Assessing Solvency

Examining a company’s ability to meet its long-term obligations is a critical facet of cashflow analysis.

Evaluating Liquidity

Liquidity, the ease of converting assets into cash, is a pivotal factor in short-term financial health.

Projecting Future Financial Health

Anticipating future cashflows aids in strategic planning and risk mitigation.

Challenges in Cash Flow Analysis

Navigating the complexities of cash flow analysis comes with its challenges:

Perplexities in Forecasting

The unpredictable nature of economic variables poses challenges in accurately forecasting cashflows.

Addressing Burstiness in Cash Flows

Abrupt fluctuations in cash flows, or burstiness, require proactive measures to maintain stability.

Best Practices for Effective Cash Flow Analysis

Ensuring effective cashflow analysis involves adopting best practices:

Regular Monitoring and Reporting

Consistent monitoring and timely reporting are essential for proactive decision-making.

Utilizing Technology

Leveraging financial technology tools streamlines the analysis process, enhancing accuracy and efficiency.

Professional Expertise

Engaging with financial experts ensures a comprehensive and nuanced approach to cashflow analysis.

Common Mistakes to Avoid

Steering clear of common pitfalls is crucial in effective cashflow analysis:

Neglecting Timing Issues

Timing is everything, and overlooking the timing of cash inflows and outflows can lead to misjudgments.

Underestimating Non-Cash Items

Non-cash items, such as depreciation, must be factored in to avoid distorted cashflow perceptions.

How to Master CashFlow Analysis

Mastery is an ongoing journey:

Continuous Learning

Staying abreast of industry trends and updates is essential for mastering cashflow analysis.

Networking and Knowledge Sharing

Engaging with peers and industry experts facilitates knowledge exchange and continuous improvement.

Conclusion

In conclusion, mastering cashflow analysis is indispensable for sound financial management. As businesses embrace the complexities, continuous learning, and practical application will pave the way for proficiency.

You can also read “How profit margins show the financial performance of your business ?”

If you have any doubt regarding this topic, feel free to comment below and we will try to cover that as soon as possible.

FAQs

- What is the primary purpose of cashflow analysis?

Cash flow analysis primarily aims to assess a company’s ability to generate cash, meet financial obligations, and make strategic decisions. - How often should businesses conduct cashflow analysis?

Regular monitoring is crucial; businesses should ideally conduct cash flow analysis monthly and on an annual basis. - Are there industry-specific considerations in cashflow analysis?

Yes, industries may have unique cash flow dynamics, and a tailored approach is recommended. - How can small businesses overcome resource constraints in cashflow analysis?

Small businesses can leverage technology, seek professional advice, and focus on key financial indicators to overcome resource constraints. - What role does technology play in modern cashflow analysis?

Technology streamlines the analysis process, offering real-time insights, predictive capabilities, and enhanced accuracy.

Pingback: Best Accounting Methods For Small Businesses In 2024 » Moneyfinacc.com

Pingback: Can Your Business Survive With 0 Cash? Proven Strategies For Success