Introduction

In the dynamic world of small business, navigating through financial intricacies is a crucial aspect of ensuring long-term success. One such aspect that demands careful consideration is the choice of accounting methods. Let’s delve into the best accounting methods for small businesses, understanding their nuances and how they can impact your bottom line.

Importance of Choosing the Right Accounting Method

Accounting methods are the structured approaches businesses use to track and report their financial transactions. The choice of method can significantly influence how a business’s financial health is portrayed, affecting both internal management decisions and external perceptions.

Impact on Financial Reporting

The selected accounting method determines when transactions are recognized, directly influencing the timing of revenue and expense recognition. This, in turn, affects the accuracy of financial reports.

Tax Implications

Beyond financial reporting, the accounting method chosen can have profound implications on a business’s tax obligations. It’s essential to align your accounting method with tax regulations to optimize tax planning and compliance.

Cash vs. Accrual Accounting

Two primary accounting methods, cash and accrual, cater to different business needs and circumstances.

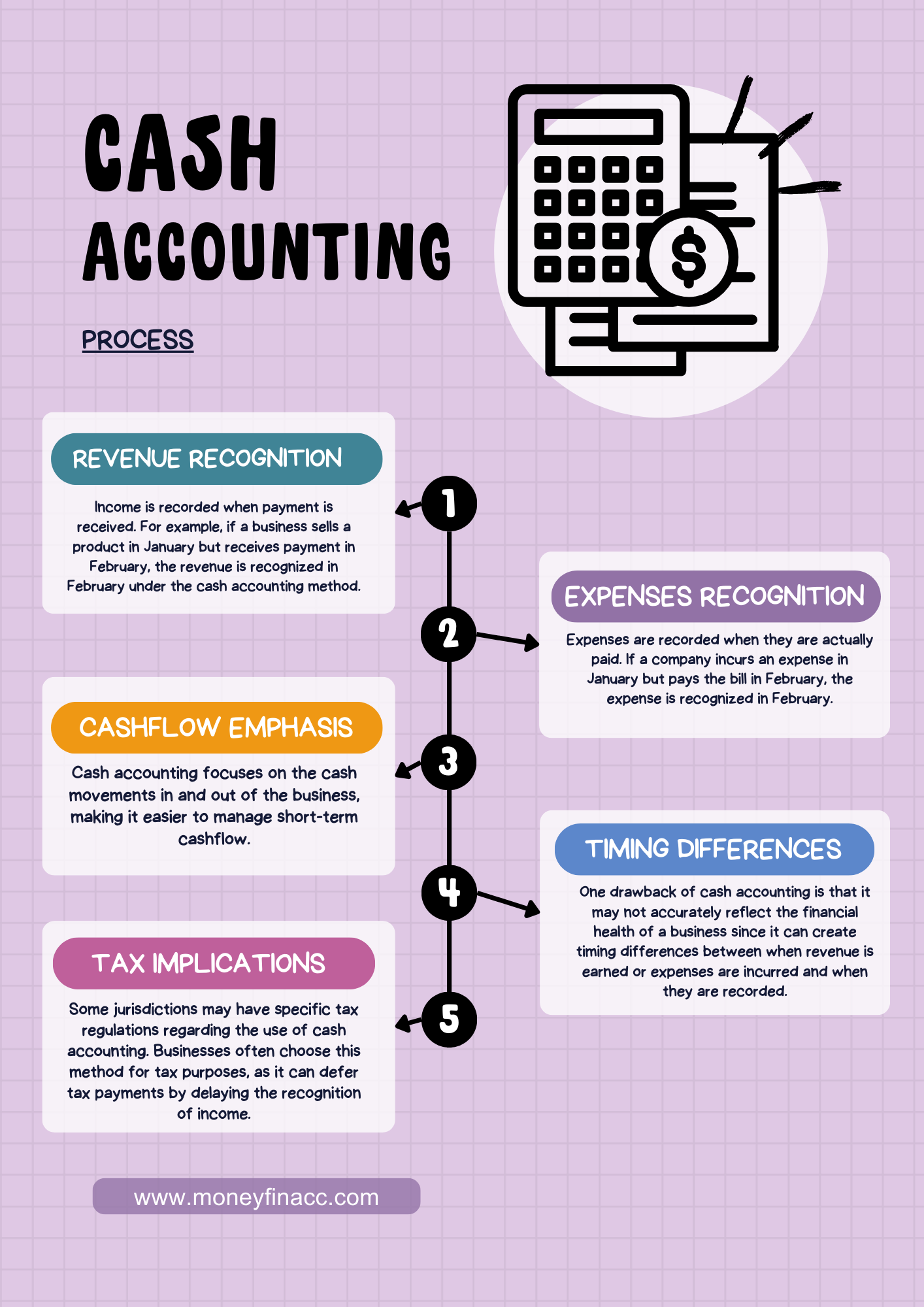

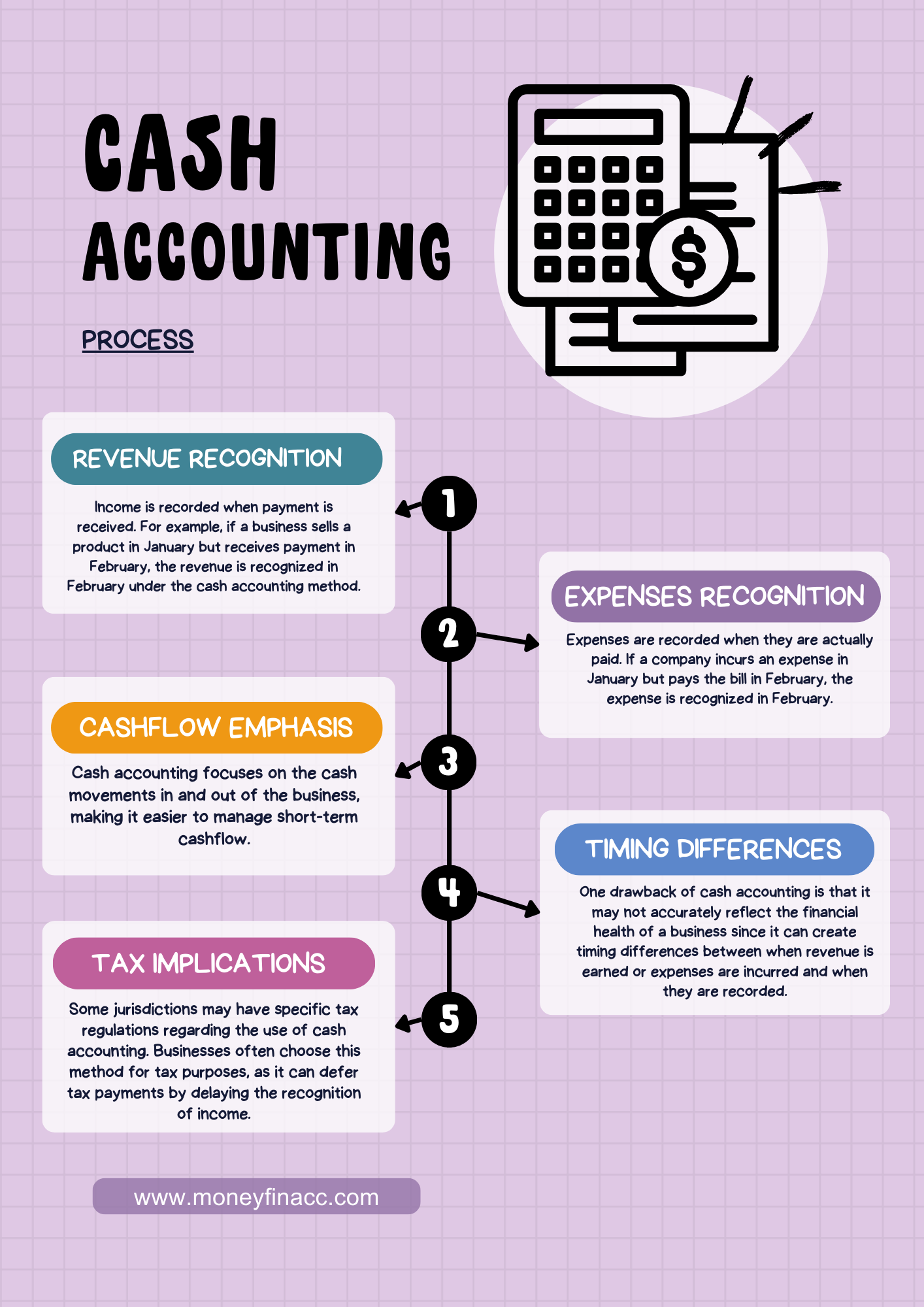

Understanding Cash Accounting

Cash accounting is an accounting method where transactions are recorded when actual cash is received or paid. In other words, revenue is recognized when payment is received, and expenses are recognized when they are paid. This method contrasts with accrual accounting, where transactions are recorded when they are incurred, regardless of when the cash is exchanged.

Here are key characteristics of the cash accounting method:

Exploring Accrual Accounting

Accrual accounting is an accounting method that records revenues and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. This method contrasts with cash accounting, which records transactions only when cash changes hands.

In accrual accounting, transactions are recognized in the financial statements at the time they are earned or incurred, even if the related cash flow has not occurred. This method provides a more accurate representation of a company’s financial performance and position over a given period.

Here are the key principles of accrual accounting:

Advantages and Disadvantages of Cash Accounting

Simplicity and Transparency

Cash accounting is straightforward, making it easy for small businesses to manage. It provides a clear picture of actual cash available.

Limited Long-Term Planning

However, cash accounting may limit long-term financial planning, as it doesn’t capture future income or obligations until cash changes hands.

Advantages and Disadvantages of Accrual Accounting

Matching Revenue and Expenses

Accrual accounting matches revenue with expenses, offering a more accurate reflection of a business’s profitability over time.

Complexities in Record Keeping

Yet, accrual accounting demands meticulous record-keeping and may pose challenges for businesses with irregular cashflow.

Hybrid Accounting Methods

The term “hybrid accounting method” typically refers to a combination of different accounting principles or methods within a single organization or accounting system. This approach allows businesses to customize their accounting practices based on specific needs or circumstances. Here’s an explanation of the key elements involved in a hybrid accounting method:

1. Combination of Methods:

– A hybrid accounting method might involve using accrual accounting for certain aspects of financial reporting, such as revenue recognition and long-term asset management.

– At the same time, it might use cash accounting for other areas, such as managing day-to-day operational expenses.

2. Tax Considerations:

– Businesses often choose accounting methods based on tax regulations. A hybrid approach could involve using different methods for financial reporting and tax purposes to optimize tax liability.

3. Complex Transactions:

– In situations where a business engages in complex transactions, a hybrid accounting method may be employed to ensure a more accurate representation of financial performance and position.

4. Industry Specifics:

– Some industries have unique accounting requirements. A hybrid method may be adopted to comply with industry standards for certain aspects of financial reporting while using a different approach for other aspects.

5. Flexibility:

– Hybrid accounting provides flexibility to adapt to changing business needs. It allows for a tailored approach that best suits the organization’s financial goals and reporting requirements.

6. Reporting Accuracy:

– The goal of a hybrid method is often to achieve a balance between the precision of accrual accounting and the simplicity of cash accounting. This can lead to more accurate financial reporting.

7. Internal vs. External Reporting:

– A business might use different accounting methods for internal management reporting and external financial statements. This helps in aligning internal decision-making with external reporting requirements.

It’s important to note that while a hybrid accounting method can offer flexibility, it also requires careful management to ensure consistency and compliance with relevant accounting standards and regulations. Companies need to communicate transparently about their chosen accounting methods in financial statements to provide a clear understanding to stakeholders.

Choosing the Right Method for Your Small Business

Choosing the right accounting method for your small business is a crucial decision that can impact your financial reporting, tax obligations, and overall business strategy. Here are some considerations to help you make an informed choice:

a. Business Size and Complexity:

Smaller businesses with straightforward transactions may find cash basis accounting more manageable. Larger or more complex businesses may benefit from accrual basis accounting for a more comprehensive financial picture.

b. Tax Implications:

Consider how each method affects your tax liability. Some small businesses may have the flexibility to choose between cash and accrual basis for tax purposes. Consult with a tax professional to determine the most advantageous option.

c. Industry Standards:

Certain industries have specific accounting standards. For example, service-based businesses might lean towards cash basis, while retail or manufacturing businesses often use accrual basis accounting.

d. Timing of Transactions:

Evaluate when your business typically receives payments and incurs expenses. If there’s a delay between the sale of a product or service and the receipt of payment, accrual accounting may provide a more accurate financial picture.

e. Investor and Creditor Preferences:

If seeking external financing or investment, consider the preferences of investors and creditors. Accrual basis accounting is generally considered more reflective of a business’s financial position.

f. Consistency:

Consistency is key for financial reporting. Once you choose an accounting method, it’s typically best to stick with it. Changing methods can complicate financial analysis and may have tax implications.

g. Software Compatibility:

Ensure that the accounting method you choose is supported by your accounting software. Most software can handle both methods, but it’s essential to set it up correctly.

h. Regulatory Compliance:

Understand the regulatory requirements for your industry and location. Some businesses may be required to use a specific accounting method.

i. Future Growth:

Consider the scalability of your chosen method. If your business is poised for growth, accrual basis accounting may provide a more sustainable foundation.

Conclusion

In conclusion, deciding the best accounting method for small businesses in 2024, it’s crucial to weigh the pros and cons of cash accounting and accrual accounting. If simplicity, real-time cash insights, and potential tax advantages are priorities, then cash accounting may be a practical choice. Alternatively, businesses aiming for a more detailed financial overview, industry compliance, and precise revenue and expense matching may find accrual accounting to be a strategic fit.

When making this decision, consider your business’s specific needs, consult with financial professionals, and plan for the future. Consistency is vital, and once a method is chosen, it should align with your business’s unique characteristics.

Small businesses are advised to embrace accounting practices in 2024 that not only address immediate needs but also set the stage for sustainable growth and financial transparency. Ultimately, the best accounting method is one that empowers your business to make informed decisions, navigate financial challenges, and thrive in a constantly changing economic environment.

FAQs

1. How often should I review my accounting method?

Regularly review your accounting method whenever there are significant changes in your business’s size, nature, or industry requirements.

2. Can I switch accounting methods mid-year?

While it’s possible, it’s advisable to plan the switch during low-transaction periods to minimize disruptions.

3. Do all small businesses need accounting software?

While not mandatory, accounting software greatly simplifies financial management, reducing errors and providing valuable insights.

4. What is the role of a professional accountant in choosing a method?

A professional accountant can offer tailored advice based on your business’s unique needs and help navigate the complexities of accounting methods.

5. How does the chosen accounting method impact budgeting?

The chosen method directly influences how revenue and expenses are recognized, affecting the accuracy of budgeting and financial planning.